Running a business is like riding a bike—until you hit a pothole. Suddenly, you’re tumbling, wondering why you didn’t pay more attention to the road. One of those “potholes” is ignoring your financial records. If you’ve ever thought, “I’ll just wing it!” when it comes to keeping track of your money—well, we need to have a little chat.

Bookkeeping is the unsung hero of your business. It’s the spreadsheet that’s always there, silently doing the heavy lifting while you’re off chasing the next big idea. But why exactly is it so important? Let’s break it down.

1. Conquer your Finances: Like a Financial Superhero

We know, we know. Numbers can be boring. But the truth is, bookkeeping is the financial GPS that helps you navigate your business journey. Without it, you’re driving blindfolded. Keeping track of income and expenses ensures you don’t end up in a situation where you’re spending money you don’t have. And no, guessing doesn’t count as bookkeeping (unless you enjoy getting very surprised by your tax bill).

Proper bookkeeping gives you the power to see where your money’s going. If you’ve ever looked at your bank balance after an impulsive purchase and thought, “Well, that escalated quickly,” you know exactly what we mean.

2. It Saves You Time, And Keeps Your Sanity Intact

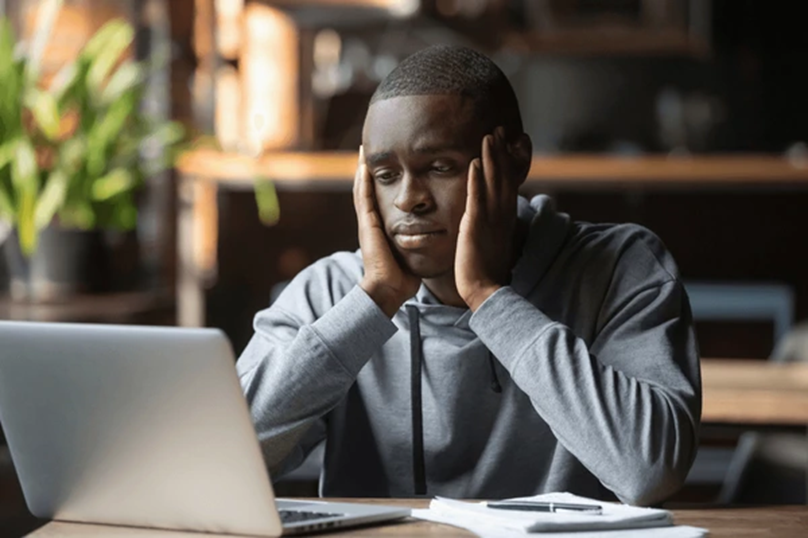

Think of bookkeeping like a loyal assistant who handles all the boring stuff, so you don’t have to. Without it, you’re scrambling around like a person who misplaced their car keys—except the “keys” are your receipts, invoices, and financial documents. And trust us, nothing adds more stress to your life than looking for a receipt on April 15th (spoiler alert: it’s not fun).

Having organized books means you can spend less time digging through piles of paper and more time doing what you love (like running your business without the stress of tax season looming).

3. Stay Compliant with Tax Laws – Or, You Know, Out of Trouble

Let’s be honest: taxes are scary. You don’t want to end up in a situation where the tax authorities knock on your door and ask, “So, how are your finances looking?” without having any solid answers. Proper bookkeeping ensures you don’t have to panic come tax season.

In The Gambia, businesses with properly maintained financial records (that are audited) enjoy tax perks. If your accounts are audited, you pay a reduced quarterly tax rate of 1.5%, as opposed to the 2% tax rate for un-audited accounts. If you’re going to pay taxes, might as well pay less, right? And you can only be audited if you have your bookkeeping right.

4. It Helps You Make Smarter Business Decisions – Like Not Buying That Fancy laptop.

So, you’ve got this brilliant business idea—and that’s great! But you can’t make decisions based on gut feeling alone. Sure, that MacBook looks amazing, but what’s your cash flow situation? Bookkeeping helps you make informed, smart decisions about what your business can afford. No one wants to end up like the guy who bought a luxury computer only to realize he can’t pay rent. (That’s not the dream we’re talking about here.)

When you know where your business stands financially, you’ll be able to make decisions that move you closer to success, not closer to bankruptcy.

5. It Provides a Strong Foundation for Growth – Because, Who Doesn’t Want to Grow?

Planning to expand? Attract investors? Apply for a loan? Here’s the thing: no one is going to lend you money or invest in your business if you don’t have solid financial records to back up your ideas. Investors and banks love clean, accurate financial statements. Without them, you’re basically saying, “Trust me, it’ll work out!” And, spoiler alert, that’s not how business works.

Having proper bookkeeping in place gives your business a foundation of credibility. When you have the numbers to back you up, you’re more likely to get the backing you need to grow your business to the next level.

6. Prevent Fraud & Strengthen Internal Controls (Because We All Like to Avoid Disasters)

Here’s where bookkeeping becomes your financial bodyguard. A good bookkeeping system can help you spot any funny business (and not the good kind). If you’ve got unauthorized transactions or accounting errors creeping up, a solid bookkeeping system will flag them before they become major issues. Think of it as your financial detective.

This doesn’t mean you’re paranoid; it just means you’re protecting your business from the stuff that could sink it. Because, let’s face it, no one wants to find out that they’ve been “paying” for a vendor who doesn’t exist (or worse).

The Challenge for Small Businesses (And How Remaccs Saves the Day)

We get it. Small businesses often face a tough time justifying the cost of hiring a full-time bookkeeper. You’ve got a million things to do, and adding “financial wizardry” to your to-do list might feel like a stretch. But that’s where Remaccs comes in!

Our team of experienced and dedicated experts is here to handle the books while you focus on what you do best: following your passion and growing your business.

With us, you don’t have to stress about the numbers; we’ve got it covered. That way, you can concentrate on what truly matters (like that next big idea).

We won’t judge you for not liking numbers, we would rather help.

At Remaccs, we make bookkeeping simple. We offer professional bookkeeping services to help businesses of all sizes stay on track. From transaction recording to generating reports, we’ll take care of the numbers while you take care of your business. No more stressing over spreadsheets—we’ve got this!

Bookkeeping — Not Just for the Nerds!

Look, we know that bookkeeping might not be the coolest part of running a business, but trust us—it’s the thing that holds everything else together. From staying compliant with tax laws to making smarter decisions and preparing for growth, bookkeeping is your ticket to long-term success.

And let’s not forget about those sweet tax perks. In The Gambia, businesses with audited accounts enjoy a lower tax rate (1.5% instead of 2%). The catch? You need to have your books in order first. That’s where Remaccs comes in. While we don’t conduct external audits ourselves, we ensure your bookkeeping is on point, so when you’re ready for an audit, you’re already ahead of the game. If you’re ready to hand over the books to the pros and get back to running your business, contact us today. We’ll keep things balanced while you keep things exciting.